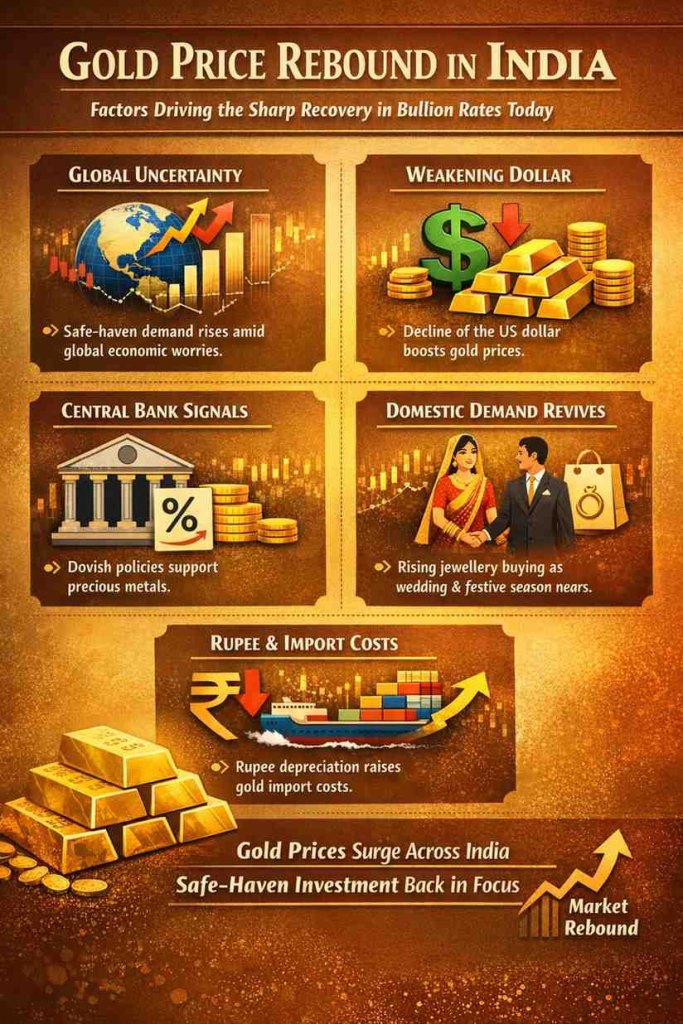

After weeks of subdued movement and cautious sentiment, gold prices across India have staged a sharp rebound today, catching the attention of investors, jewellers, and households alike. Rates for 24-carat and 22-carat gold have climbed notably in major cities, reversing the recent downward trend that had prompted many buyers to stay on the sidelines. This sudden recovery is not driven by a single trigger but by a combination of global cues and domestic dynamics that have realigned market expectations in favour of the yellow metal.

Global Uncertainty Rekindles Safe-Haven Demand

One of the strongest forces behind the rebound is renewed global uncertainty. International markets are once again grappling with mixed economic signals from major economies, including concerns over slowing growth and uneven recovery prospects. In such an environment, gold traditionally regains its appeal as a safe-haven asset. As global investors move funds away from riskier instruments, international gold prices have firmed up, directly influencing domestic bullion rates in India.

Weakening Dollar Lifts Gold Prices

The recent softness in the US dollar has also played a crucial role in supporting gold prices. Since gold is globally priced in dollars, a weaker greenback makes the metal cheaper for holders of other currencies, boosting demand. This inverse relationship has been clearly visible today, with international bullion prices rising in tandem with the dollar’s decline, and Indian markets quickly reflecting this shift.

Central Bank Signals Support Precious Metals

Another key factor driving the rebound is the evolving stance of major central banks. With inflationary pressures still not fully under control in many parts of the world, expectations of prolonged accommodative or cautious monetary policies have strengthened. Gold, which offers protection against inflation and currency depreciation, benefits from such outlooks. Even subtle signals from global central banks have been enough to push institutional investors back toward precious metals.

Domestic Demand Shows Signs of Revival

On the home front, India is witnessing a gradual revival in physical gold demand. Jewellers report increased enquiries and purchases as consumers view the recent correction as a buying opportunity. With the wedding season approaching in several regions and festive buying sentiment beginning to build, retail demand has provided an additional boost to prices. This renewed interest has helped absorb supplies in the domestic market, adding upward pressure on rates.

Import Costs and Rupee Movement Add to Momentum

The movement of the Indian rupee against the US dollar has further contributed to today’s price recovery. Any depreciation in the rupee raises the cost of gold imports, which are entirely dependent on overseas supplies. Even modest fluctuations in the currency translate into noticeable changes in domestic gold prices, amplifying the impact of global price movements.

Investor Sentiment Turns Cautiously Optimistic

The sharp rebound has also influenced market psychology. After a period of consolidation, today’s upward move has reinforced the perception that gold continues to hold long-term value despite short-term volatility. Investors who had adopted a wait-and-watch approach are reassessing their strategies, while those with existing holdings see the rebound as validation of gold’s role as a portfolio stabiliser.

What Lies Ahead for Gold Prices

While today’s recovery is significant, market experts caution that gold prices may remain volatile in the near term, tracking global economic data, currency movements, and geopolitical developments. However, the underlying factors supporting gold—uncertainty, inflation concerns, and steady domestic demand—remain firmly in place. For Indian consumers and investors, the rebound serves as a reminder of gold’s enduring relevance, not just as a cultural asset but as a financial hedge in unpredictable times.

As markets digest fresh cues in the coming days, gold’s trajectory will continue to evolve, but today’s sharp recovery has once again put bullion firmly back in the spotlight across India.

Add newspixel.in as a preferred source on google – click here

Last Updated on: Tuesday, February 3, 2026 11:56 am by News Pixel Team | Published by: News Pixel Team on Tuesday, February 3, 2026 11:56 am | News Categories: News

Comment here